The ever-increasing popularity of demat accounts infers that more investors are moving to equities, derivatives, bonds and other financial securities in the stock market. A demat account makes the investing process of these securities with a significant profit potential convenient. It can help you complete the share transfer process swiftly without stepping out of your home. Demat-based trading is a time-saving approach to stock market investing. Stock traders can buy and sell securities within a fraction of a second.

Let us learn more about the benefits of demat account and the opening process.

What is a Demat Account?

Following the SEBI’s (Securities Exchange Board of India) trading norms, opening a Demat account is necessary to trade dematerialized securities. It facilitates easy trades for investors.

- A demat account is a digital account that stores your financial assets safely in an electronic format. You can access all your assets online by logging in to your demat account.

- In India, you need to open your demat account with Depositories – the NSDL or the CDSL by approaching a depository-authorized stockbroker.

- Each and every security you buy can be held in your demat account. It includes all the investments – equities, government securities, mutual funds, bonds, and derivatives under one roof.

You can open a basic service demat account (BSDA) or a regular demat account with a stock broker as per your investing requirements. There are a few demat account costs investors need to bear. The stock brokers offer demat account services against demat charges, like account opening charges, maintenance charges, debit charges, etc. For free demat account opening, consider a reputed discount broker. You can open a minor demat account and NRI demat account also by following set rules by the SEBI.

What is the Purpose of Demat Account Opening?

The primary purpose of opening a demat account is to hold securities you bought in dematerialized form in the stock market and make the stock trading process easy.

There was a time when investors had to trade paper-based share certificates on the grounds of public stock exchanges. Handling paper-based securities was a big hassle for investors as they would take too long to trade. Also, there was a huge possibility of damages to papers. A demat account helps investors to remove such issues. You can store all your financial securities in a demat account and access them on an electronic device.

As mentioned in the next subhead, there are many other facilities and functions a demat account offers or performs. It will give you more clarity on the purpose of opening a demat account.

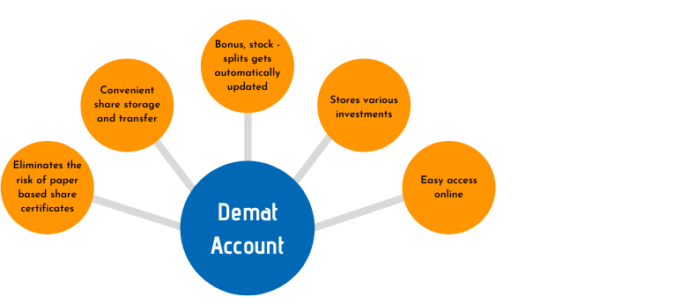

How Does A Demat Account Facilitate Investors?

- Reduced Risks: Paper-based securities are risky due to the possibility of damages, theft, loss, or forgery. Moreover, receiving duplicate securities increases this risk. With your demat account, such issues have been eliminated as investors get the opportunity of holding their financial assets electronically.

- Easy Online Access: Keeping tabs on paper-based securities and investments was tiresome. Also, checking their performance is also counted as a necessary task. Investors can ease the task using a demat account. Store and track all their investments in a single demat account.

- Reduced Investing Costs: Investing comes with various expenses. It was much higher in the offline outcry trading system associated with paper-based certificates. It was stamp duty, handling charges, etc. These costs are reduced by using a demat account to make investments.

- Trade Small Quantity: You can buy or sell any number of securities using your demat account. Even if you want to buy or sell just one share, a demat account allows you to do this. It was not allowed for physical certificates. Investors were bound to trade particular lots in the offline trading system.

- Freezing Facility: If required, you can freeze your demat accounts for a certain period. It will keep your demat securities more secure as you have prevented debits from your demat account. You will keep receiving dividends, interest, or refunds even after freezing your demat account.

- SPEED E-Facility: You can change the form of securities online – from paper to electronic. You need to send instruction slips electronically to the broker. It will make the process quick and convenient.

What is the Process of Demat Account Opening?

The demat account opening process starts with approaching a stockbroker. It is a digital process with renowned discount brokers that only takes 15 minutes to open your demat account. Here is the process:

- Open the Demat Account Opening Form at the official portal of the broker.

- Enter personal details – name, Email ID, mobile number, and PAN number.

- Upload KYC documents – Aadhar number, ID proof, Address Proof.

- Complete an in-person verification process. Record a short video and send it to the stockbroker.

The broker will send you a confirmation regarding the demat account activation after the verification process. You will receive your demat account login credentials. Log in and start your investing journey.